flow through entity tax break

Under the Tax Cuts and Jobs Act pass-through business entity owners can potentially deduct 20 of their business income. Flow through entity tax break Wednesday March 9 2022 Edit.

A Complete Guide To The Singapore Corp Pass A New Digital Identity For Companies To Transact With The Gov Singapore Business Business Infographic Infographic

Pass Through Entity Tax Treatment Legislation Sweeping Across States Bkd.

. The majority of businesses are pass-through entities. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. Flow-through entities are used for several reasons including tax advantages.

Questions rema in September 2018. Many small businesses are set up as flow-through entities meaning the income from these businesses is taxed at the owner of the businesss tax rate instead of taxed separately. As a result individuals.

Shareholders of a flow-through entity however are only taxed at their individual income rate. This deduction began in 2018 and is scheduled to last through 2025that is it will end on january 1. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

The tax break allows owners of pass-through businesses like sole proprietors partnerships and S corporations to deduct up to 20 of their business income from taxes. The Moment of Truth. The purpose of flow-through tax forms is to attach income to a tax-paying entity namely you.

When an investor is looking to purchase a flow-through entity they are doing so because they believe that they can receive. Furniture with a 7-year tax life is acquired in Year 1 for 10000. By Stephen Fishman JD.

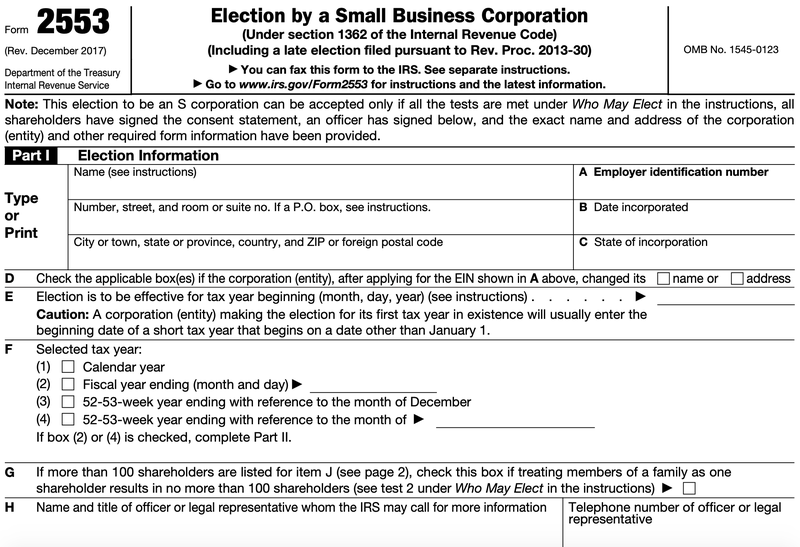

Recent Comprehensive Tax Reform Proposals. This is done via the Schedule K-1 on Form 1120S. California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018 Connecticut issues Pass-Through Entity Tax guidance.

Business entity which is transparent for tax purposes. The MI flow-through entity tax is retroactive to Jan. Report of the National Commission on Fiscal Responsibility and Reform December 2010.

Rules for Flow-Through Entities. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow. Shareholdersmembers of such pass-through entities can then claim a credit on their Michigan individual income tax returns for.

For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation. The main difference between the two entities is the tax advantages. The Tax Cuts and Jobs Act TCJA the massive tax reform law that took effect in 2018 established a new tax deduction for owners of pass-through businesses.

It also includes an llc taxed. In the end the purpose of flow-through entities is the same as that of the other business entities. Common Types of Pass-Through Entities.

Simple Fair and Pro-Growth. Applying the simplified assumptions contained in this example the after-tax income for an owner of a PTE 60 is 25 greater than the after-tax income for an owner of a C corporation 48. A flow-through entity is also called a pass-through entity.

As with a C-corporation flow-through entities must file their inventory accounting documents depreciation records and profits. We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan.

Often the owners of a corporation must take a distribution in order to pay their corporations taxes. The after-tax cash flows to an owner can be materially different depending on the entity form as illustrated in Exhibit 1 applying 2013 tax rates. Some key takeaways for tax and accounting professionals include.

In Year 11 it no longer is. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. Pass-through owners who qualify can deduct up to 20 of their net.

Although fully depreciated by then the property remains qualified property under Sec. Follow the links below for more information on these topics. Us Income taxes guide 117.

Subsequent tax years is generally not. Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005. This is an interesting conundrum because you pay tax on profits whether or not you take any distributions.

Passive Activity A trade or business in which. 1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments. Tiered Entities Material participation is based on the.

With an election in place and payment of the necessary taxes the pass-through entity can then deduct the amount of taxes paid without limitation on their federal tax returns Form 1120S for S corps Form 1065 for partnerships. The income of the business entity is the same as the income of the owners or investors. Flow-through Entities Tax Articles.

As well as links to websites and other resources of interest to the flow-through entities tax community. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. 199A rules through the end of Year 10 contributing the full 10000 to the entitys Sec.

The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. Llcs are what is known as a flow through entity. The main difference is that C-corporations are first taxed at the corporate rate and then again when their shareholders receive capital gains.

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity could have more than one activity. Tax Advantages Of Esops Employee Stock Ownership Plan How To Plan Capital Gain Pass Through Taxation What Small Business Owners Need To Know. 199A unadjusted basis of property computations.

The income of the owners of flow-through entities are taxed using the ordinary.

A Beginner S Guide To Pass Through Entities The Blueprint

Tax Advantages Of Esops Employee Stock Ownership Plan How To Plan Capital Gain

Pass Through Taxation What Small Business Owners Need To Know

Pin On Singapore Business Infographics

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Learn Accounting

Pass Through Entity Tax 101 Baker Tilly

What Is The Best Type Of Company Co Inc Llc Corp Ltd Etc And What Do They All Mean Business Tax Business Structure Law Firm Business

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

California Enacts Elective Pass Through Entity Tax Pte Holthouse Carlin Van Trigt Llp

Pass Through Entity Definition Examples Advantages Disadvantages

Qbi Information For Pass Through Businesses Business Sweepstakes Winner Writing

Accounting Basics Accounting Basics Trial Balance Accounting

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

What The New Tax Bill Means For Small Business Owners Freelancers Business Tax Deductions Small Business Finance Business Tax

Here Are Some Accounting Tips To Ensure An Error Free Accounting And Business Growth Accountingtips Accoun Cloud Accounting Accounting Accounting Software

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

Benefits Of Incorporating Business Law Small Business Deductions Business