schedule c tax form llc

Information about Schedule C Form 1040 Profit or Loss from Business. Schedule C is for two types of business a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation.

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Schedule C Defined.

. The profit is the amount of money you made after covering all. About Form 1099-MISC Miscellaneous Income. Supervisor Information Form Please put a check in the box next to the type of application the applicant is submitting.

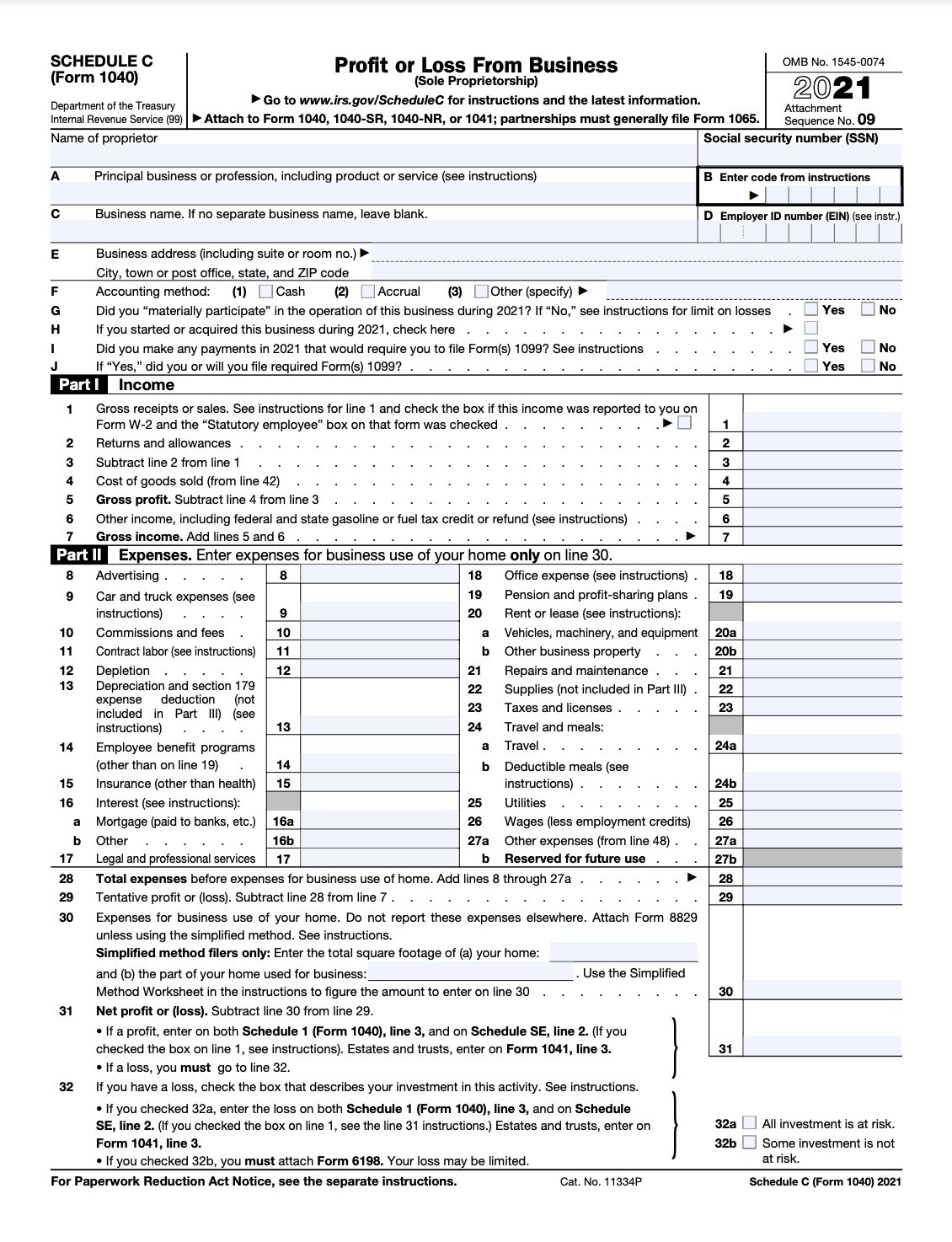

The Schedule C tax form is used to report profit or loss from a business. Section 501c3 organizations and 4947a1. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United States by a.

The IRS website has a copy of the Schedule C tax form as well as Instructions for Schedule C. Income Tax Return for Estates and Trusts. About Form 1041 US.

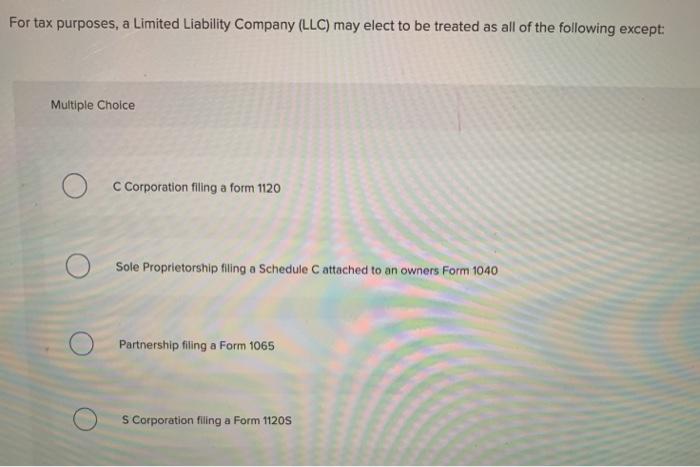

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. You will file the LLCs federal income tax return using IRS Form 1065 US. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Single-Member LLC and.

The Schedule C tax form is not for. 10642I Form 990-EZ 2000 The organization may have to use a copy of this return to satisfy state reporting requirements. Profit or Loss From Business on Form 1040 is where independent contractors sole proprietorships single-member LLCs and gig workers.

Application Note to supervisor. It is a form that sole proprietors single owners of businesses must fill out in the United States when. You and your spouse must each report your individual shares of the income generated.

Return of Partnership Income. Even simple sole proprietorships usually require multiple other.

What Do The Expense Entries On The Schedule C Mean Support

Solved For Tax Purposes A Limited Liability Company Llc Chegg Com

How To Fill Out Schedule C Stripe Help Support

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your Schedule C Perfectly With Examples

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

24 Best Schedule C Services To Buy Online Fiverr

How To File Llc Taxes Legalzoom

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Filing A Schedule C For An Llc H R Block

Solved Schedule C For Llc How To Report Income From A Foreign Cooperation

Guide To Filing Business Taxes

Schedule C Instructions With Faqs

Are You Exposed Considerations When Funding A Single Member Llc

Additional Schedule C Wilson Financial Wealth Management And Financial Planning

How To Fill Out Schedule C For Business Taxes Youtube

Indie Authors Should Consider Using Schedule C Tax Forms Irs Tax Forms Irs